Have you ever thought about how your customer’s experience is tightly intertwined with the health of your brand? Each experience with your product or service can have an impact on how your brand is perceived overall. A positive experience often leads to higher brand loyalty and increased praise about that experience via word-of-mouth. A negative experience can have the opposite effect. Likewise, preconceived perceptions about what a brand stands for and delivers can impact the expectations of what that customer’s experience will be.

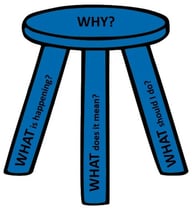

To provide a complete picture of your customer’s experience and how that intersects with your brand perception, it is important to answer three key questions.

1) What is happening in the marketplace?

2) What does that mean to your company?

3) What can you do with that information?

Think of these questions as a three-legged stool. If one leg is missing, the stool will fall over. Let’s take a closer look at each question.

What is happening in the marketplace?

Competitive analyses and brand health research should be a continuous process to proactively assess risks and opportunities in the marketplace. The key terms here are “continuous” and “proactively.” Staying ahead of competitors will allow you to capitalize on trends and strategically position your brand to consistently meet and exceed expectations.

Conducting a competitive analysis sounds simple. All you must do is make a list of who your competitors are and conduct a SWOT analysis to assess their strengths and weaknesses, right?

Wrong. While that’s important, a true competitive analysis goes much deeper and involves looking at the landscape from multiple angles, including:

1. Who is your competition?

This is the fundamental list that I mentioned above. However, your actual competition includes any company that could potentially entice your customers to buy their product rather than yours. For example, your direct competition may include companies that are creating cheaper knock-off products or solutions or smaller companies that have recently begun to show a lot of growth.

2. What are customers saying about you and your competition?

Customer experience is a known driver of satisfaction, and research shows that 91% of B2B sales is influenced by word-of-mouth. By interviewing customers of both your brand and your competition you can begin to identify strengths, weaknesses, and where potential gaps are. Similarly, online reviews and other social media platforms allow you to explore the experience customers are having with your competition. Two programs that our clients find value with are the Sales Win Loss Analysis and Customer Churn Analysis.

3. How does your brand awareness compare to your competition?

Brand awareness is a measure of familiarity with your brand and tracks whether customers can recall and recognize your brand in relation to your competition. Since customers are more likely to purchase a product or service from a well-known or established brand, ensuring your brand is part of their consideration set will be crucial to growth.

4. How are brands in your competitive landscape positioning themselves?

An effective messaging and content strategy can be used to sell the benefits of your product or service to potential customers. Look at the website or other communications by your competition. How are they differentiating themselves? What are the sales tactics and key messages they are conveying to potential customers? With this knowledge, you can test your own content against the competition to measure effectiveness with your target audience.

5. How do your products, services, or features compare to your competitors?

If there’s a ‘perception gap’ between what you believe the benefits of your offering are versus what your customers experience, they are more likely to consider a competing solution. Likewise, knowing what is happening in the marketplace will help you identify a new product, service or marketing angle that will set you apart.

6. Are you competitively priced?

Knowing what your competition is charging for similar products and services or whether they use discounting methods can help ensure your costs are perceived as reasonable to potential customers. Competitive pricing does not require that you be less expensive. If you believe that your product or service is superior, you will need to craft messaging that communicates the benefit and value of your product or service versus competition.

What does that mean to your company?

With a good understanding of the competitive landscape, the next step is to determine what this information means to your organization. This doesn’t mean you should simply decide to counter each insight that you learn about competitors. The key is asking some tough questions that can change the internal perspectives on how to use the insights to have true competitive implications. If you only focus on an action plan, you risk creating a band-aid solution that only addresses the symptom rather than the root cause.

To make competitive information actionable, consider looking at the information gathered and determine which is crucial to the success of your organization.

Some questions to ask yourself include:

- What do I need to learn from my customers to ensure continued growth?

- What is the competition doing better than your organization?

- How can you capitalize on your strengths to ensure your product or service stands out?

- How does my brand awareness affect my sales?

- Are there emerging threats in the marketplace?

- Are we advertising in the correct channels and saying the right thing to entice customers?

- How can you communicate competitive insights across your organization to maximize the impact?

Identifying what competitive results mean to your organization is often achieved through close collaboration between your research partner and internal stakeholders to ensure an unbiased interpretation and prioritization of the insights that an organization can use.

What can you do with that information?

Research reports often provide a long list of data-heavy slides showcasing the specific results of the study. While the insights may be interesting, many stakeholders are left wondering how they can use that information to meet business objectives. As a researcher, it is imperative to make the connection that bridges the gap between what we learned about the brand to how we can use that information to improve the customer’s experience.

By determining what insights are crucial to the success of the organization and examining the amount of resources needed to remedy that situation, you inherently prioritize which initiatives to place on either a short-term or long-term roadmap.

Below are examples of how competitive intelligence insights can be used.

- Take themes from qualitative interviews and ideate ways to solve for each

- Plot potential solutions, noting the ease to complete versus the amount of delight for the customer

- Design a brand awareness campaign and track improvement over time

- Identify gaps and opportunities to improves your customer’s experience

- Develop a compelling website and advertising content that appeals to your target customer

- Test concepts for new product introductions

- Create a process to communicate insights across the organization to maximize effectiveness

Finally, every stool must include a seat. The seat of our stool is the WHY and is the piece that holds everything together. Employing a mixed-methods approach by combining both quantitative research to learn WHAT and the qualitative information to dig into WHY ensures a well-informed picture of your brand and customers.

Finally, every stool must include a seat. The seat of our stool is the WHY and is the piece that holds everything together. Employing a mixed-methods approach by combining both quantitative research to learn WHAT and the qualitative information to dig into WHY ensures a well-informed picture of your brand and customers.

Without a deep understanding of the motivation and drivers of the customer, we are only seeing part of the picture about why the customer’s experience is driving changes in the marketplace or brand perception. However, that is a topic for another day.